Holiday season and social climate:

The last few years have been atypical to say the least and eCommerce/shopping was greatly affected by the social climate. During the pandemic-driven hibernation in 2020, eCommerce was thriving because there was less opportunity for travel and subsequently more funds for purchases; particularly in demand for at-home use (candles, athleisure, office supplies) and digital education/fitness apps.

Starting in 2020, COVID was the catalyst for the change in consumer behavior. We began to see some relaxed restrictions with a slow return to offices, and more customer demand for Airbnb/staycation/travel experiences as well as general in-person activities with family/friends. Still, the landscape was not quite identical to pre-pandemic behaviors, and in tandem with this shift, modeled META data, the looming threat of cookie deprecation, shipping/demand issues and rising CPMS, there are additional layers of changes bringing a new transformative time in the industry.

With all these social changes, platform nuances and industry transformations, how do we use the data we have to better inform our holiday strategy and prepare for 2022?

Evaluating 2021

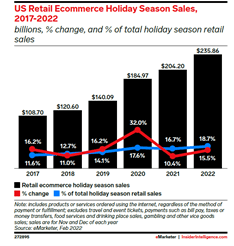

To look ahead to this year, we need to evaluate 2021. The prior holiday season had the “strongest retail growth in more than 20 years” due to increasing customer spending. The expectation is for this metric to grow to 1.262 trillion in 2022, with 15.5% coming from e-commerce, while brick-and-mortar is expecting 1.026 trillion.

The 2021 Review

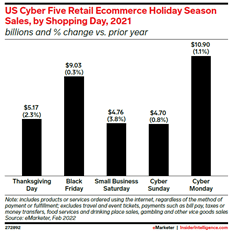

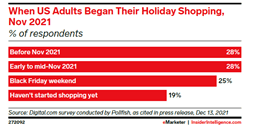

- Fewer users shopped Cyber Monday/Black Friday overall and most shopped earlier to avoid inventory/supply chain issues and subsequent shipping delays.

- Spending increased, particularly at brick-and-mortar retail stores, as there was a large appetite for in-person shopping/consumers were in a better place financially than the prior year. This included in-store shopping for apparel for in-person events/office usage.

Key stats (eMarketer 2022 Preview Report)

- Retail spends grew 16% YoY to 1.221 trillion.

- Mobile e-commerce accounted for 45.9% of sales, and 61% of digital visits and is projected to be almost 50% in 2022.

- Brick & mortal sales increased 17.3% to 1.017 trillion.

- Cyber Monday had the highest spending day online.

- Black Friday inched up to .3% while Thanksgiving grew 2.3%.

What should you do with this data?

- Ensure your holiday planning/creative is approved assets to be ready for an earlier time in market and to be seen among the clutter as many brands will be present earlier.

- Invest in video assets because these have higher costs, but they see great LTV/revenue and work well with static.

- 2022 will have a longer holiday cycle, with less spend during the typical post-Thanksgiving period. So, you’ll want to ensure you have a strong evergreen presence. You should release seasonal/holiday messaging earlier to align with consumer demand. No longer do you need to save funds for the holiday spending all in late Q4.

- Consider starting early and implementing flat spending if it aligns with your business. Last year there were Black Friday promotions as early as October, and in general, holiday discounting was only 9% in 2021, vs. 14% in 2020, so monitor competitors/trends to see if this continues into 2022.

- Because brick-and-mortar sales increased, you should consider setting up store locator ads and ways to track your in-store or online ads. “Click to collect” drove 1 in 4 online transactions, so, if possible, you will want to set this up, and run CTV ad campaign tests.

- Cyber Monday should still be priority and if you have an offer; be sure to showcase/be present as this is still an instrumental day.

- As there are significant mobile visits and share of revenue, you will need to ensure your ads and user experience is mobile friendly. Invest in app/shops, in preparation for this influx.

- To drive purchases and rise above the clutter, ensure each receives a specific user journey and relevant messaging for where they are in funnel (new user vs. returning) and start soft vs. heavy copy to drive user to convert.

- Invest in your CRM data and learn from it as well as promote to repeat customers from these list with special offers to drive loyalty and continued purchases. Consider establishing a program/reward for these users.

- Test influencer marketing, that way your product is top of mind and when they are ready to purchase, you aren’t as affected by audience modeling.

- Ensure you utilize the shop features and continuing to monitor new features (i.e.: FB/IG shop, and enabling checkout within platforms, dynamic ads for hyper targeting ads to users that have seen specific products etc.) of the platforms and ensure you have an integration with a tool like Shopify, so you’re accurately tracking performance.

- Consider using a listening tool, to continue to meet consumer expectations and change messaging/strategy based on feedback, with a tool like Sprout Social.

With eCommerce growth back to mid-teens, rising 15.5% to 235.86 billion, the channel is back to pre-pandemic levels. However, we still anticipate earlier holiday shopping to stick as demand will occur earlier in the holiday season, and these habits were established for several years now. Profitero’s Black hypothesized:

“October will be the permanent new kick-off for the holidays, because it feels normal now after two years and it gives retailers three months to make their number versus two. ”

That’s not to say you shouldn’t be in market during the big three (Cyber Monday, Black Friday, and Thanksgiving) but the strategy should start earlier while we monitor trends/industry changes.

Of course, it’s early and there are several factors to look out for, as we move toward the early holiday season, that will impact projections/spend.

- Inflation/Labor Market Changes and General Economy health (i.e.: if gas prices go up, users will have less discretionary income).

- If stores close, during Black Friday for social climate changes, this will impact spending.

- If Prime Day (Apple) or large brands (Amazon, Walmart etc.) change their holiday calendar, it is likely to have a trickledown effect.

- COVID/Social Landscape.

There is no one-stop solution. So, it’s important to speak with experts like us so you consider historical performance, creative and the audience targeting that out-performed. With previous insights/data and the above, you are set up for another successful holiday season.

POV by: Gellena Lukats, Director, Paid Social