This year, change has been a constant in the social media world. In addition to media measurement changes, increasing privacy concerns, pandemic shopping fluctuations, platforms are leaning into their product capabilities. These changes, spurred by iOS 14.5 – such as decreased audience sizes, reduced targeting capabilities, and increased platform costs – have ushered in 2022 as a major transition period for social.

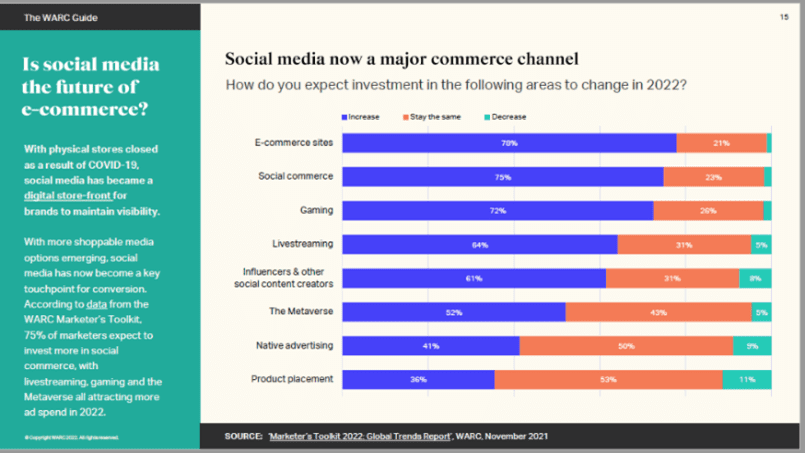

While there have been stock fluctuations, new modeled data, and much adversity for social platforms (especially Meta), there have also been improvements in the eCommerce world. And, social’s role is now recognized as not just a view-through channel, but as an important part of the user journey that is instrumental to product success.

Covid-19 expedited the online shopping experience and created digital touchpoints that bridge the gap between online and in-store shopping. Thirty-three percent of sales are made through e-commerce this year, whereas this metric was twenty-three percent pre-pandemic.

Customer Experience

Social media is a channel that showcases customer experience, feedback & engagement. The unsolicited communication of messages on social platforms and at-mentions (i.e.: Twitter) are great ways to get learnings/insights from customers and because it is self-reported, it increases the authenticity of the data. By keeping open communication/transparency, social provides an avenue to obtain direct product feedback for improvements to eCommerce features. Consumers will create their own path to purchase, and social provides guidelines regardless of where they are in the process (discovery, or ready to buy immediately.) Therefore, it’s important to create experiences that lead to brand recall; experiences like sharing recipes/coupons for a restaurant brand to drive users to dine (WARC guide)

Social Listening tools like Sprout Social or Hootsuite can help you search for keywords, monitor trends, and develop content capable of impacting messaging and ultimately guiding product success; an example of this has been the impact of users’ feedback on corporate sustainability and ultimately consumer responsibility. 4.62 billion of the world’s population is on social and the incremental reach/impact with this platform is unparalleled. One out of every two consumers look for deals specifically on social, making this a great channel to tout promotions and special products and offers.

With data depreciation, first-party data, lookalike modeling & customer personalization are the keys for customer success in a cluttered landscape. You need to define your key audience, use contextual marketing insights, and use the top performing segments for retention, re-engagement and brand loyalty. Be sure to store this data in a compliant way and check you are targeting the correct user on the right platform.

Online channels are now the primary driver for social eCommerce, with over 60% of customers saying they find browsing online easier than being in store. The ease of use of social media lends itself as a great discovery channel. “Online window shopping is also higher,” with sixty-one percent browsing online and only thirty-four percent in store. Correlate store locator data with Snapchat/Meta, but make sure the online experience continues to be king.

While there is no one-shop answer and users will still probably want to buy a significant number of mattresses/televisions in-store, brands can create digital touchpoints that lend to effective shopper journeys, as well as incorporate assets that are engaging, snackable, and drive performance.

Social is growing

In 2020, the average person spent three hours a day on social, vs. 90 minutes in 2012.

Messaging has grown forty percent since 2020, and mobile is key at over 4 hours of activity on average per day.

There is unparalleled time spent on these apps, and you want to make sure your products are being shown and you are fully monetizing on this growth of online activity and subsequent shopping behaviors. Social is not just a place for discovery/awareness: fifty-one percent of users said content they find on social media sites does lead to them to buy a product, adding social to the mid-funnel success, consideration phase.

More than 80 million people made purchases via social in 2020, and the projection is set to be 101.1 million by 2023.

Even industries like travel, which have faced major struggles from the pandemic, have increased their usage of eCommerce investments and tools. This is partly due to demand, but also consumer willingness to employ new tactics like virtual shopping and live streaming, the latter of which has attracted the likes of retail brands like Burberry and Louis Vuitton.

There is less and less separation between in-store and online experiences; the two need to continue to merge and syndicate. In fact, specifically for higher priced, luxury brands like Burberry, customers are coming back eight times to research products, so you want to make sure there is a personalized, robust customer experience, that takes individuals through the funnel while listening to customer needs/expectations.

Platform Capabilities are Growing

Facebook and Instagram (Meta) developed Shops in 2020, bringing stores where users can make purchases to the platform. IG Shop Tags and posts were also developed, so users can have seamless clickable access to products based on the ads they see. There is already a beta with live shopping/influencers on the platform; with the rise of these features in Meta, we anticipate more AI/shopping capabilities as well as integrations with feeds/user behaviors through platforms like Shopify that are not as affected by cookie-based marketing. FB/IG Shops make purchasing an item seamless and the tie-in with influencer marketing is specifically large with Instagram. Even though Facebook has seen some dips in revenue/users, its shop capabilities are growing, and we do anticipate some virtual reality shopping features in the future.

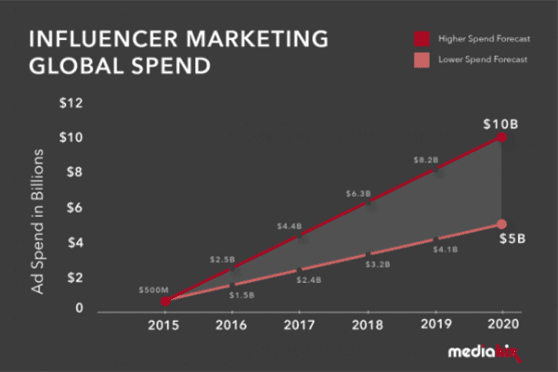

A large part of influencer marketing success is through Meta, and this is set to grow to $15 billion this year. As platforms realize these results, they are expanding these features at an exponential rate. With social’s access to first and third-party data, as well as these new features at play, social helps guide the user purchase.

Pinterest integrates the same shopping feed as “Meta,” allowing you to retarget/remarket those that have added a product in the cart, viewed products or actively searched for relevant keywords. You can customize your collections within product groups, ensuring personalization in tandem with dynamic retargeting, and use a Shopify integration to import seamlessly, while implanting conversion API.

Twitter, like Meta, has dabbled in Live Shopping, and has tested e-commerce for organic tweets that drive tweets to a shop button with product, shop name price, and product details. This is also a great area for customers to @ your brand and share e-commerce feedback/information.

TikTok is impacted largely by the influencer market, as well as YouTube. Now, just like with Pinterest, there is a Shopify Integration, so users don’t have to exit the app to explore products. In addition to live stream integrations, TikTok shopping has been piloted, allowing for shopping tabs on the profile, like with Meta.

LinkedIn is a great platform for niche audiences, especially in verticals like education. The first-party data and self-identification for member groups helps reach a professional audience, which can be used for e-commerce. For instance, if you are selling software to teachers, you can schedule appointments with “lead generation” or “start conversations” forms. This is a great place to nurture those relationships.

As you can see, most of the platforms use similar features. For a good e-commerce strategy, it is important to have strong creative assets, with a particular preference for video/short form; measure audience impact on each channel; and focus on multi-media measurement through another partner. If you can see where social lands in the user journey, and for what purpose, the impact from social on e-commerce is unparalleled.

Influencer Marketing is Key

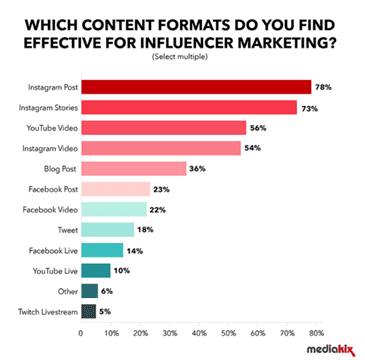

With privacy as a key focus, it is more important than ever to show engaging, authentic, and personalized content, especially for the awareness and consideration phases of the funnel.

While users are likely to ad block/opt-out of traditional ads, this is not the case for influencer content, making this impactful during cookie deprecation.

Additionally, there is more clout when it comes to influencers. Forty-nine percent of Consumers depend on Influencer recommendations, and forty percent have purchased after seeing influencer content. In fact, ninety-two percent of consumers trust influencers more than traditional ads/celebrity endorsements, showcasing the effectiveness of the strategy. With a wide range of micro vs. macro influencers, there is certainly an engaged market by content type available for the taking.

This form of paid media continues to grow, and we anticipate this becoming an important phase of the e-commerce journey for social, especially considering growth trajectory. Influencer marketing has expanded exponentially over the past two years. Worth just $1.7 billion in 2016, the industry is set to reach $13.8 billion this year.

With the willingness of platforms to invest in influencer capabilities, and some even investing in influencers themselves (TikTok Creator’s Fund), it’s more important than ever to properly vet influencers through brands like Influential that are equipped with special consumer insight tools.

Specifically, Influential uses IBM Technology that helps you learn the brand presence, interests and potential reach of consumers who are engaging with niche communities and interests (i.e.: beauty brands would work with beauty influencers vs. targeting a beauty interest in platform). This audience is key to success. It’s important for brands to find effective content and markets based on properly vetting content creators and using their community to drive brand interest and endorsements your users can trust.

Align your Team

Each brand and stakeholder must work with internal and external parties to ensure it is clear on KPIs and how to gauge success; and to ensure it keeps the consumer in mind while being privacy compliant. Make sure you are clear with your goals, and drive purchase intent on each platform.

The Journey

Customers are looking to brands for experiences, but each brand needs to do its own deep dive of success. Ensure you use best performing assets at different touchpoints (prospecting vs. remarketing) and across channels.

“A strategy for different verticals will require a bird’s eye view and remember to build the brand for long time retention,” Head of eCommerce at WaveMaker, Mudit Jaju, said. “Building strong bias before a consumer begins an online shopping journey improves a brand’s odds of being considered before purchase by fourteen percent,” he also stated.

Ensure you are personalizing your messaging, but continue to test, monitor, and optimize as this is a fast-paced, changing landscape. You want to make sure you stay relevant and noticed among the clutter.

If you’d like a consultation on how to make the social commerce landscape work for you, please contact us. We are here to help.

POV By Gellena Lukats, Acronym’s Director, Paid Social