2023 Holiday Season Review and Tips for Future Social Commerce Efforts

By Gellena Lukats, Director, Paid Social

As we enter Q1, it’s crucial for marketers to gauge the effectiveness of 2023 social holiday campaigns and use these learnings both in this quarter and to plan next year’s social commerce program. This article covers the importance of social commerce, the industry and state of affairs as a whole, so you can make this year one for the books.

State of Affairs:

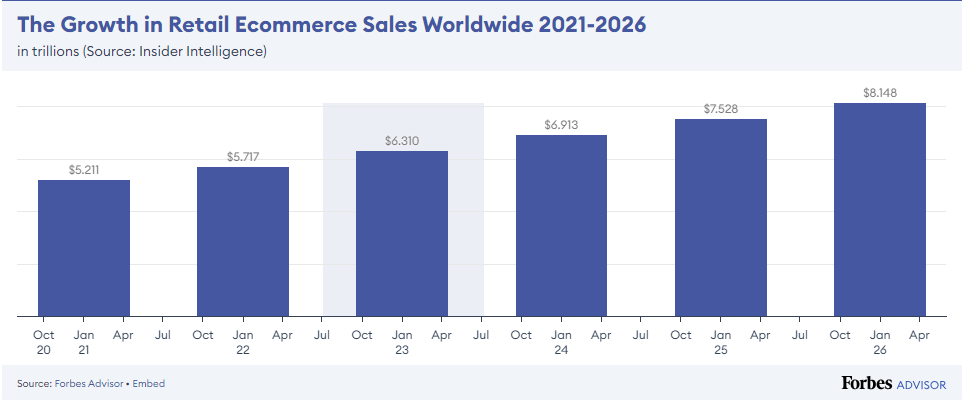

The U.S. economy grew by 5.2% in Q3. Despite the slight growth, GDI shows “income is lagging” and “MacQuarrie Group said this gap hasn’t been this big since the 2007-08 Great Recession”. While there is improvement in the economy, there is still a small decline, “with a low-single digit-rate expected for 2024″ according to Finch Ratings. That said, due to low unemployment rates and easing inflation, it offsets some poor trajectories. Because of all these factors and COVID affecting projections, it is hard to gauge and project 2024 impact overall. We will continue to monitor this and industry trends, but overall can still see a small increase, with 2025/2026 projected to normalize, and by 2026, 24% of all retail purchases are expected to happen online.

Amazon has 37.8% of sales, so the push in Q4 for the META/Snap integration, shows more social ecommerce capabilities in 2024, although due to walled gardens there is still not enough data shared by Amazon to see impact of this or the Snapchat partnership.

Amazon has 37.8% of sales, so the push in Q4 for the META/Snap integration, shows more social ecommerce capabilities in 2024, although due to walled gardens there is still not enough data shared by Amazon to see impact of this or the Snapchat partnership.

More consumer behaviors to consider going into 2024:

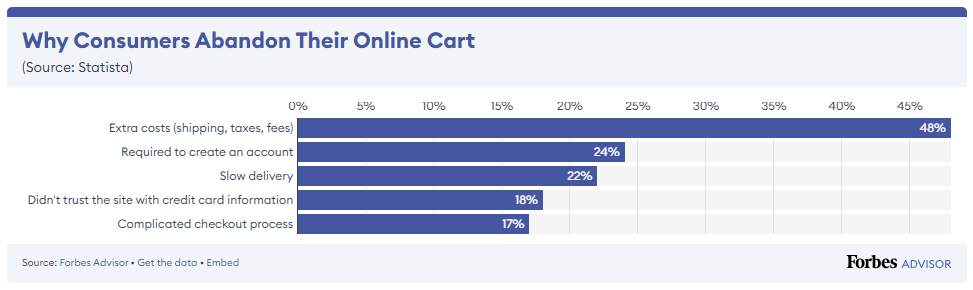

As we are seeing a lot more online activity, we want to make the user experience as seamless as possible, especially on mobile experiences. Ensure that extra costs are limited if possible and user experience is easy to navigate. Shipping deadlines, checkout process and poor landing page experiences are clear deterrents, so ensure a step such as requiring an account to complete checkout isn’t a barrier to entry as 24% will abandon their cart due to this. If you saw these issues this holiday season, tweak this in Q5 and be ready for the next holiday period.

Social Ecommerce

Social Ecommerce

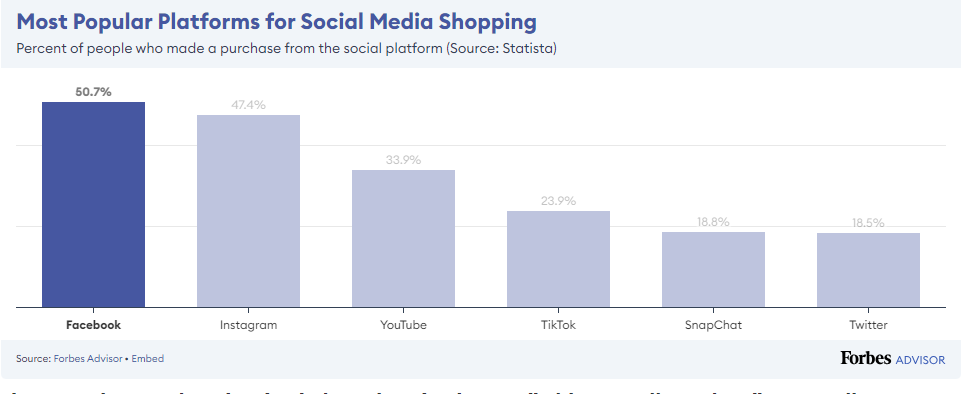

Social ecommerce is expected to reach 2.9 trillion by 2026 and 969 million people in the US shop on social, with millennials shopping the most – showcasing effectiveness with the younger demo. This projected impact extends to global reach; for example, in China, 50% have purchased from social channels. As we can see platform matters, with Facebook and Instagram driving the purchases. Although you do want to ensure you are running an effective media mix. If you have limited funds, and you need to run on solely one social platform, META would be the place to start.

Influencer marketing is also key with 49% of shoppers saying influencers have impact; this is particularly high among teens (70%) with 40% in general saying social gives them influence. Depending on your demo/target audience and goals, consider these platforms, while ensuring you work on your analytics/fraud protections to prioritize preventing e-commerce fraud. In fact, by 2025, fraud is estimated to reach over $69 billion, so ensure you have checks/balances in place, especially with larger reach campaigns.

Influencer marketing is also key with 49% of shoppers saying influencers have impact; this is particularly high among teens (70%) with 40% in general saying social gives them influence. Depending on your demo/target audience and goals, consider these platforms, while ensuring you work on your analytics/fraud protections to prioritize preventing e-commerce fraud. In fact, by 2025, fraud is estimated to reach over $69 billion, so ensure you have checks/balances in place, especially with larger reach campaigns.

Key insights for social ecommerce:

- Shopper mindset: Inflation isn’t deterring consumers – but they are buying on credit.

- Consumer sentiment has remained positive despite inflation. More shoppers say they’re feeling optimistic this year, and fewer report feeling frustrated. (5)

- Shoppers opting for Buy Now, Pay Later (BNPL) options saw sizable growth over Cyber weekend.

Holiday Overall Trends

Google has compiled some Holiday Retail Insights for us, specifically for the Cyber Period.

KEY HIGHLIGHTS/Recommendations:

- Record-breaking online weekend: Black Friday: $9.8B (+7.5% y/y), Cyber Monday: $12.4B (+9.7% y/y). Recommendation for next year: Focus more funds on Cyber Monday, as we see this day peak for performance and for many clients, shoppers spend more on this day versus the entire three days of Cyber Weekend.

- In-store sees slight decline: Store foot traffic dipped slightly (-3.4% y/y), and online sales outpaced brick-and-mortar. Recommendation for next year: Test store locator ads/more integration capabilities.

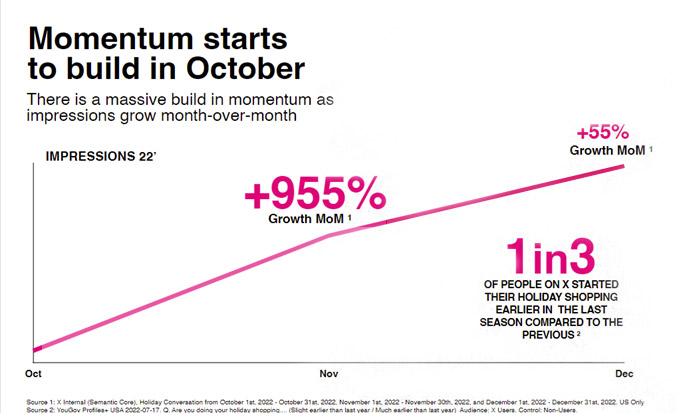

- We saw early performance in October/November. Recommendation for next year: Scale performance leading into holiday week, specifically for prospecting, while saving some for December promotions. Decrease budgets after the promotional periods/shipping deadlines to ensure you are in market when it matters, especially during peak holiday bids.

- Mobile played a significant role, with over half of online sales occurring through smartphones (54%, +12.7% y/y).(4)

Recommendation for next year:

- Ensure your mobile user experience/destination URL is user friendly to drive more purchases.

CATEGORIES THAT COUNTED: Consumer spending prevails amid tighter inventory

- Cyber steals: best-selling categories online on Black Friday included Electronics, Apparel, Appliances, Toys and Jewelry.(4)

- Right-sizing retail: Shoppers were holding out for discounts, reporting they were looking to see 30% discounts before they began spending.(9) After last year’s excess inventory challenges, retailers pivoted to more focused inventory this holiday. According to Salesforce, SKUs per catalog were down -3% while average price per item was +4% y/y, and in most categories, the greater the SKU reduction, the higher the price.(10)

- Shopping small, buying global: Smaller merchants are benefiting from international sales, with 15% of all Shopify orders on Black Friday crossing borders. Top selling countries were the US, UK, and Canada, and hottest categories globally were clothing, personal care, and jewelry.(16)

Recommendation for next year: Ensure you have offers for top categories as available, ensure you have timely offers early especially with inventory concerns, and monitor performance of small businesses/global categories.

Besides the overall look, there are nuances to each platform, specifically on X (formerly known as Twitter), i.e., on X, engaging with hashtags like #holiday, helps you join the conversation and launch new products with user sentiment and feedback. i.e., Cyber Monday/Black Friday, but also Giving Tuesday and Small Business Saturday can be considered. Look at what’s driven the higher YoY growth and specifically verticals like fashion and beauty, travel and pets are over-indexing, but we still see an 18% growth in ecommerce trending topics on X. X is a great discovery tool with 51% on platform to discover brands, 49% for shopping ideas and 42% to find deals. While not at the same purchase rate as META, this is the platform to launch/start that initial conversation. While platforms like Pinterest are for large life events such as weddings, new houses and life moments.

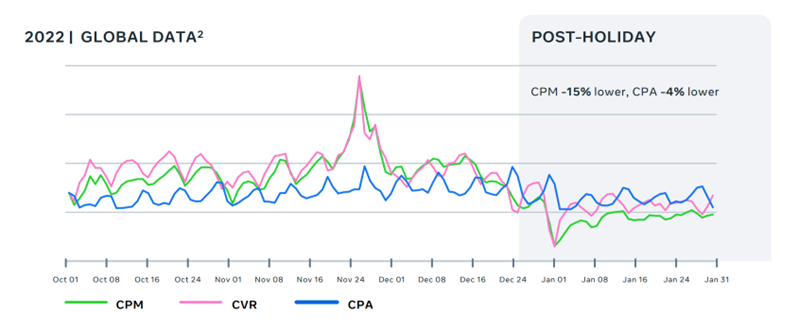

Going into the next year, we do know that post-holiday in Q5, is where we see peak performance for a lot of brands without a lot of the competitive bids of Q3/Q4. To scale in this time is still valuable as 41% of shoppers continue to shop past the holiday period, and we see much more efficient costs (below is an example from META showcasing that in Jan CPM was 15% more efficient and conversion rate was only down 8%), making this a good time to start strong in the New Year, especially coupled with New Year’s messaging. As an advertiser, you still want to offer sales and discounts, and help consumers make returns as well as spend any gift cards they may have received as part of the holiday season.

Looking for a resolution? Ensure you are:

- Still using best practices of the platform – avoid too many changes to avoid re-entering learning phase.

- Use tools like Advantage+ Shopping for automated solutions while using AI to reach consumers likely to purchase.

- Diversify your creative and messaging in the platform, partner with creators and ensure you are resonating with your end user.

- Looking at social listening while looking at metrics this year and last, to forecast Q5 and be ready for the next holiday season.

There is never a better time to take the lessons learned from Holiday Season ‘23 and begin adjusting your 2024 than right now. Be ready in August to jump right into your planning. Acronym can help you ramp up – contact us.

Sources:

- Adobe 2023 Holiday Shopping Trends, Dashboard results for Cyber 5, 2023

- Mastercard SpendingPulse. Nov. 2023.

- Placer.ai Black Friday Performance, Nov 2023.

- Adobe, via Digital Commerce 360, “Cyber weekend sales top $10 billion as retailers gear up for Cyber Monday”, Nov 27 2023

- Google/Ipsos, “Holiday Shopping Study” Week of November 16-22, 2023. Online survey, US, n=3669, Online US 18+ who shopped for the holidays in the past 2 days; Positive indicated by shoppers who reported feeling “Excited, Relaxed, Enthusiastic, Happy, Generous

- Mastercard SpendingPulse, Aggregate analysis of consumer spending in available gifting categories (Apparel, Department Stores, Jewelry, Home Furniture, Home Furnishings, Home Improvement), Oct – Dec 2022 data

- Google/BCG. Holiday Spending Analysis. Analysis of US Mastercard Credit Card Data December 26-January 8, 2022. Retail Categories included were: Apparel, Department Store, Electronics, Home Furniture & Furnishings, Home Improvement, Jewelry. Weekday and Weekend Analysis excludes Black Friday, Cyber Monday, Thanksgiving, and December 25th

- Google Internal Data, Black Friday demand. Nov. 2023.

- Morgan Stanley US Equity Research, November 9, 2023

- Salesforce. Shopping Insights HQ. November 27, 2023.

- YT Internal Data. Nov 2023.

- Sensormatic. 2023 Global Top Busiest Days. Oct 2023

- Google/Ipsos, “Holiday Shopping Study” Week of Nov 16-22 vs. Week of Nov 9-15, Online survey, US, n=436-494, Online US 18+ who shopped for the holidays in the past 2 days

- Data.ai, top apps across iOS and Google Play, Nov 24-26

- Data.ai, custom analysis of cross-mobile app usage in Oct 2023 (most recent data available), iOS apps for Amazon, Walmart, Target, Shein, Best Buy, and Nike. Temu cross-usage not available; TikTok comparison reflects average across retailers/brands listed.

- Shopify. “They did it again! Shopify merchants break Black Friday record with $4.1 billion in sales”. Nov. 2023.