With the rise of cryptocurrency, digital payments technology is forcing the financial system to change. Banks, which were once the biggest powerhouses that controlled the financial system and are starting to feel less powerful and want to regain control of valuable market share in an ecosystem that they once dominated. Crypto platforms like Coinbase and Crypto.com, to name a few are making billions from selling and managing Cryptocurrency, while banks and financial institution have been slow to adopt and left in the dust.

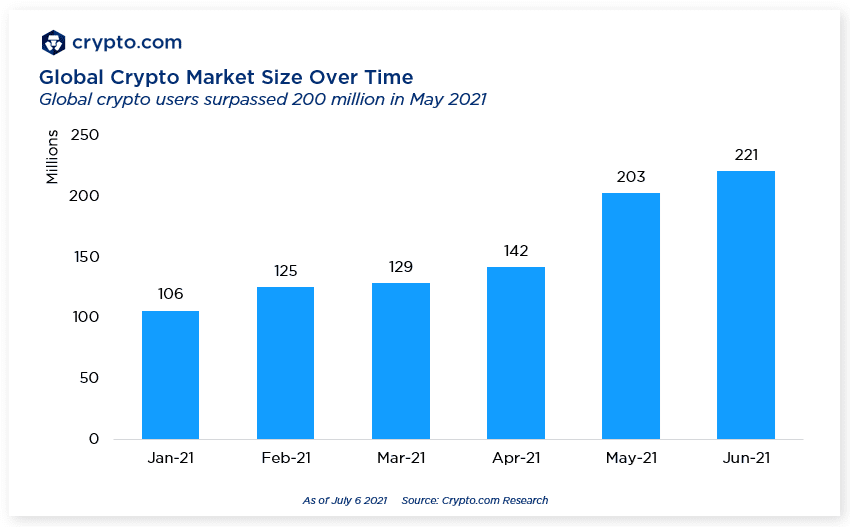

It’s no surprise that the banks tried to regulate the cryptocurrency industry but failed. There are now more than 220 million global cryptocurrency users as of June 2021 according to Crypto.com Research

Things Have Changed

We live in a digital world. In years to come all assets are going to be in a digital format. With exponential growth of the number of people using cryptocurrency worldwide, if you can’t beat them join them. Banks are now scrambling to catch up and make a profit in this new financial ecosystem of digital currency, since more and more people and businesses around the world are embracing digital currencies at a rapid pace and even governments are getting involved because everyone knows there is serious money to be made. Even in the Caribbean, Jamaica is rolling out its central bank digital currency after a ‘successful pilot’ worth 230m Jamaican dollars, according to the Guardian, the pilot for the country’s prototype central bank digital currency (CBDC) began in May 2021 and ended on 31 December 2021.

What Should Banks and Financial Institutions Do?

The answer is simple. Get involved and get involved fast. Since we’re moving at a rapid pace, banks and financial institutions should get more involved in digital currency as quickly as they can. Currently, cryptocurrency is a threat to banks because it allows people to bypass banks for transfers, sales, and other purposes by connecting people instantly without an intermediary. If I wanted to transfer money to bank account using Coinbase or any other platform, the fee is much less than if I conducted the transaction with a bank. With Coinbase, you sell crypto instantly, pay a small fee and transfer money to PayPal for free – if you have connected your PayPal account.

Some banks are starting to take Cryptocurrency seriously.

For example, look at what is happening with Bank of America, one of the largest US banks. Engineers at Bank of America filed the largest number of patent applications in the bank’s history, including hundreds involving digital payments technologies. This should serve as a wake-up call for other banks and financial institutions.

“The bank sees potential in blockchain, and we’re currently a leading patentholder in the space with more than 160 patents.”

Bank of America spokesman, Mark Pipitone, to the New York Times.

JP Morgan, also one of the largest banking institutions, introduced JPM coin which did not quite work out because it was tied to the dollar and now it is only used internally to transfer money and other assets between the banks.

Regulators, who were not ready for the surge in crypto currency are trying to create new rules that will control the use, which will probably be written to benefit them and give them a slight edge if regulation happens in the future.

Now is the Time for Crypto Content

For banks and financial institutions that are curious about cryptocurrency, it may be worth testing the waters and spending time educating your employees, shareholders, and customers. Cryptocurrency can be volatile, especially during a pandemic and its reputation has been impacted by the rise and fall of Bitcoin, the largest cryptocurrency, as well as security concerns. However, there is great potential with Crypto, less red tape, and more transparency.

Now is the time to build out a strategy for your own cryptocurrency offering services and supporting content. Here are some of the crypto-driven initiatives financial institutions should consider:

- Processing payments, loans, escrow service and facilitating international cash transactions via cryptocurrency.

- Helping customers invest by developing online learning courses to advise on the types of crypto and earning potential.

- Developing crypto-based growth assets and transactions.

We recommend adding cryptocurrency to your content strategy to satisfy the information need and connect with customer searches. Another opportunity for banks is holding money i.e., digital wallets. There are some crypto whales that store a lot of money in different virtual wallets provided by non-banks. If the banking industry can figure out how they can offer a better, more secure service, there is an opportunity to surpass non-banks in this area.

Additionally, banks could potentially invest in developing new tools that would help with the adoption of crypto by their current customers like ROI, etc., They could also offer interest-bearing crypto accounts, where customers could invest the crypto on the back end or through other financial tools.

Wrapping Up

Cryptocurrency is becoming an increasingly important trend for financial brands and payment processors, banks and financial institutions should continue to embrace cryptocurrency as most major retailers like Amazon, Walmart, Home Depot, and Costco will begin directly accepting cryptocurrencies as payment in the near future and major credit card companies, etc. Regulation will improve overtime and user adoption will continue to increase and banks should offer cryptocurrency services, including exchanges, savings accounts, and payment accounts which will become the new norm.

If you’d like assistance in developing a content plan that connects your brand to the cryptocurrency trend, let us know. We’re happy to help.

POV by Winston Burton, SVP, SEO.